About Us

Who We Are

We are a specialized asset management and consulting firm founded in 2014 and based in New York. We are driven by a deep-rooted desire to make a positive impact on our societies and to protect our planet.

Our principals have over three decades of combined experience and have managed in excess of USD 36 billion of institutional assets.

What We Do

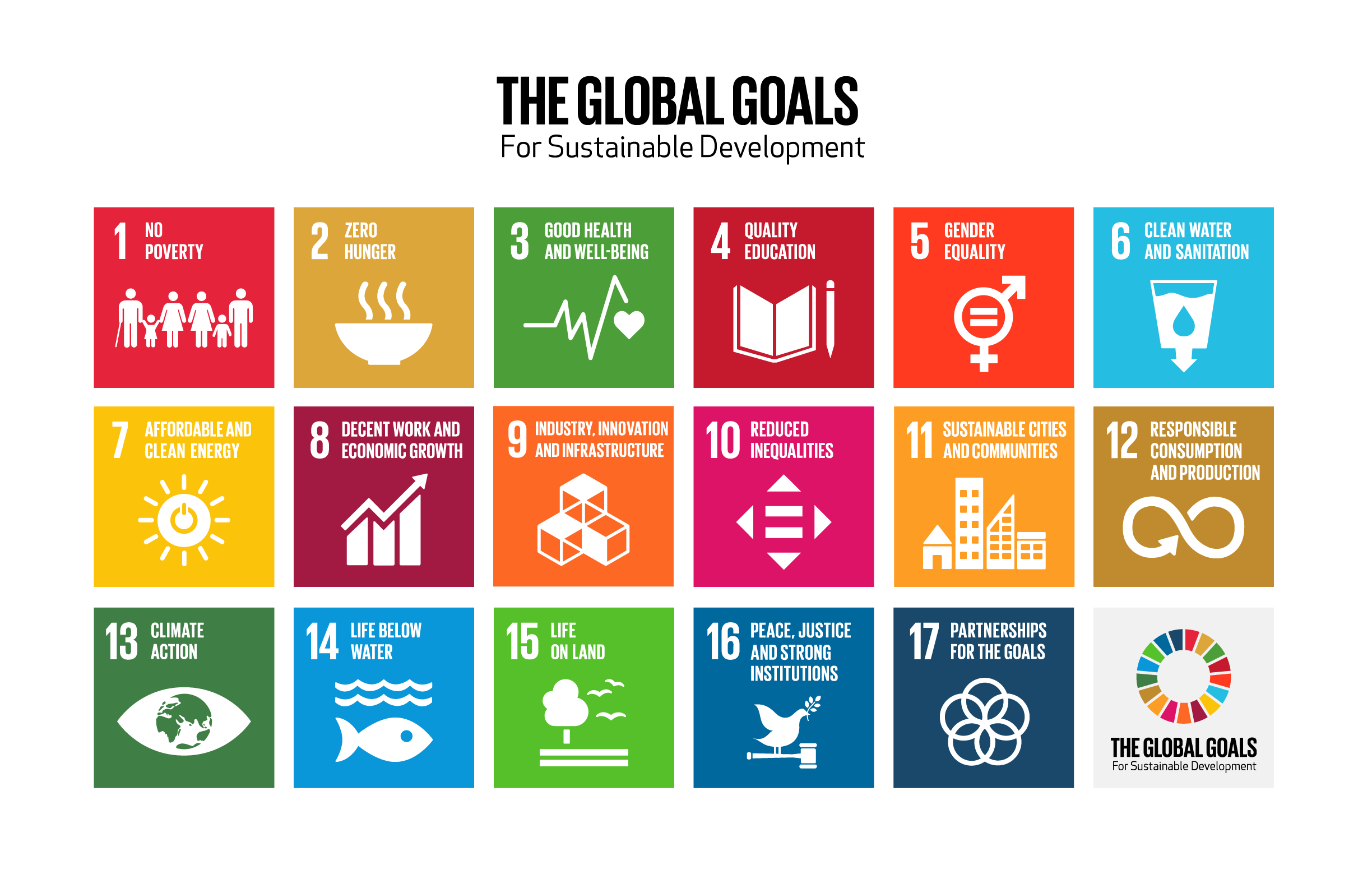

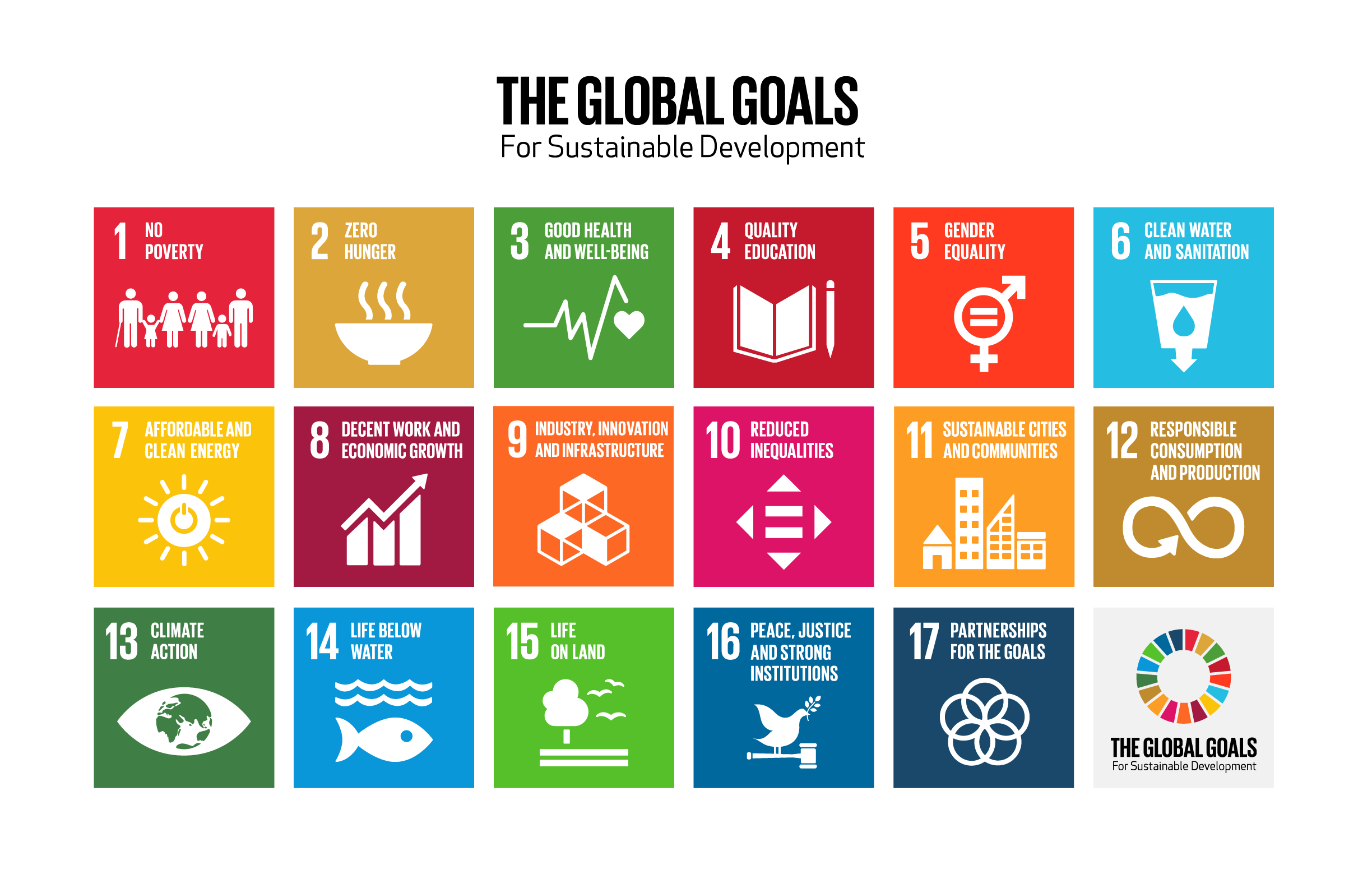

We advise on incorporating analysis of environmental, social and corporate governance (ESG) criteria in public equities portfolios.

We strive for excellence and focus on delivering an exceptional client experience.

What is SRI & ESG?

History

Sustainable, responsible & impact (SRI) investing is an investment discipline that considers environmental, social and corporate governance (ESG) criteria to generate long-term comptetitive financial returns while making a positive societal impact. SRI investing is not a new concept. The roots of sustainable and responsible investing date back centuries. Jewish, Christian, and Islamic scriptures suggest avoiding investing in enterprises that profit from products designed to enslave or harm fellow human beings.

Myths

One of the biggest myths is that sustainable investing means sacrificing returns. On the contrary, analysis by the International Finance Corporation (IFC), the Morgan Stanley Institute for Sustainable Investing, and many others shows that sustainable strategies have often performed in line with or even better than their traditional counterparts, both on an absolute and a risk-adjusted basis, across asset classes and over time.

Impact

Corporations may have either a positive or a negative impact on people, communities, and our natural environment. Today's social issues often become tomorrow's economic problems. We know that money has impact. Investment capital can finance either socially desirable or socially destructive businesses. We can make conscious choices about how our money works in the world.

Marketplace

As of 2016, approximately US$ 8.72 trillion total assets under management in the United States were allocated to SRI strategies. Globally, the United States, Norway, France, Sweden, Canada, Ireland, the United Kingdom and Luxembourg dominate the ESG investment fund landscape with the largest total assets under management.

SRI investors comprise individuals, family offices, as well as institutions, such as universities, foundations, pension funds, nonprofit organizations and religious institutions.

How We Make An Impact

We seek to make a positive impact to our planet and to humankind by contributing a portion of our profits to organizations that are on the front lines helping to protect our environment, caring for and building our societies, and campaigning for equal opportunities for all of us and for our children.

Contact

Global Alpha Asset Management LLC

P.O. Box 24

Hawthorne, New York 10532

United States of America

Telephone: +1 (914) 902-0090

E-mail: info@globalalpha-asset.com

Important Disclosure

Information

Access to this website is provided by Global Alpha Asset Management LLC (“Global Alpha”) for informational

purposes only. The publication of this website is limited to the dissemination of general information pertaining to

the consulting services offered by Global Alpha. No portion of the commentary included

herein is to be construed as a solicitation to effect transactions in securities, an offer to buy products or

services from Global Alpha, or the provision of personalized investment, tax, or legal advice for compensation

over the Internet. Any subsequent, direct communication by Global Alpha with a prospective client shall be conducted

by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state

where the prospective client resides.

Global Alpha maintains a principal place of business in the State of New York. Global Alpha may only transact business

in those states in which it has filed notice or qualifies for a corresponding exemption or exclusion from registration

requirements.

Certain information contained on this website is derived from sources that Global Alpha believes to be reliable.

However, Global Alpha does not guarantee the accuracy, completeness, or timeliness of such information and assumes no

liability for any resulting damages. The information on this website is subject to change and update from time to time.

Moreover, no client or prospective client should assume that any such information serves as the receipt of, or a substitute

for, personalized advice from Global Alpha or from any other investment professional.

Global Alpha is neither an attorney nor an accountant, and no portion of the website content should be interpreted as

legal, accounting, or tax advice. Any discussion of tax matters contained within this communication should not be used for

the purpose of avoiding U.S. tax related penalties or promoting, marketing, or recommending to another party any transaction

or matter addressed herein.

Each client and prospective client agrees as a condition precedent to his/her/its access to Global Alpha’s website, to

release and hold harmless Global Alpha, its officers, directors, owners, employees and agents from any and all adverse

consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of

personalized individual advice from Global Alpha.

ACCESS TO THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND WITHOUT ANY WARRANTIES, EXPRESSED OR IMPLIED,

WITH REGARD TO THE ACCURACY, COMPLETENESS, TIMELINESS, OR RESULTS OBTAINED FROM ANY INFORMATION POSTED ON THIS WEBSITE OR

ANY THIRD PARTY WEBPAGE LINKED HERETO.